Approximately $37 billion a year is stolen from America’s older citizens, as 5 million older Americans are financially exploited every year by scammers (according to a 2018 Bloomberg article). We’ve partnered with LifeLock to share the depth of identity theft amongst seniors throughout the U.S., how to shop online safely, and tips to secure and protect personal online information.

Senior Scam Spotlight

Seniors residing in Michigan, Florida, or California should be especially careful this season. As released within the Consumer Sentinel Network Data Book 2017, Michigan, Florida, and California residents filed the most reports of identity theft based on their state’s population in 2017. As a result of lost or stolen personal information.

- Michigan: #1 State for identity theft reports based on population- 15,027 reported cases

- Florida: #2 State for identity theft reports based on population- 31,167 reported cases

- California: #3 State for identity theft reports based on population- 55,418 reported cases

How to Shop Online Safely

Update Devices and Applications: Installing all necessary software updates will help ensure the device is operating correctly. Beyond fixing interface bugs, these updates can also contain critical software patches that address potential vulnerabilities. Without the right type of antivirus protection and online safety education, cybercriminals could introduce contaminated software designed to compromise the device or your information.

Use a Private Network or Virtual Private Network: Cybercriminals can set up, monitor, and intercept information being exchanged on a public or unsecured wifi network or hotspot. When shopping online, logging into bank accounts, or exchanging credit card information, it’s important that you’re on a secured network and website. If you rely on a public network for your Internet connection, you should research the benefits of a virtual private network (VPN) to encrypt your data exchanges.

Review Your Receipts, Billing Statements, and Online Accounts: The most effective way to identify a potential issue is through the regular review of your statements and accounts. As mentioned in the senior scam spotlight, every State has a number of organizations designed to help you navigate issues and file any necessary paperwork or reports. If you notice an issue, act quickly. Contact your lender or account provider, notify them of the unauthorized activity, and freeze credit cards before filing an official report with the correct organization. For a complete list of scams, and the resources one should contact if fallen victim, consult the scams and fraud resources on USA.gov.

Tips and Tools for Senior Shoppers

Create a new e-mail address for holiday purchases: If you’re looking to keep track of your purchases and tired of thinking of new login information for those store accounts, consider creating a new email address. Ensure that your new email is devoid of personally identifiable information including your name and date of birth. Backing the new account with a span and unique password and using it for any online purchases or store accounts will help you stay organized, and can help defend your primary account against potential scams, phishing emails, or contaminated links.

Update your passwords: It’s recommended to update your passwords every 3 months. Try using a random password generator or password managers such as LastPass to set and organize your login credentials. If possible, enable 2-factor-authentication so you can monitor and approve all login attempts.

Report Issues & Suspicions: When in doubt, check things out. Regularly review your receipts, accounts, and statements in order to address potential issues immediately.

Only Visit Verified Sites: Only use trusted sites that have a secure sockets layer (SSL) encryption. These can be identified by looking for a padlock icon in the web address box and a site address that starts with “https://”. Always avoid sites where the spelling of a commonly known site is off by one letter, as these are often scam sites. If a website seems to be too good to be true or untrustworthy, it most likely is.

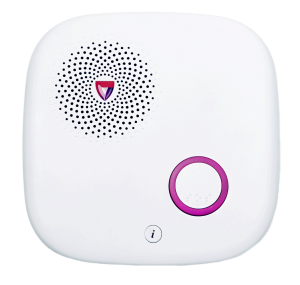

Get Immediate Help—Easily

While these tips and tricks will help the senior in your life avoid common holiday fraud and scams, we can’t protect them from every danger that comes their way. Give yourself peace of mind this holiday season by gifting your loved one with a medical alert system. With a simple touch of the “help” button, a highly trained operator will be available to speak with them, no matter what the emergency is.